Annual Giving

5k Cosmic Run

Hershey Gala

Sponsor, attend, donate to, and/or help plan this extravagant annual event with the most amazing group of people. Work turns into great fun with this group!

Volunteer

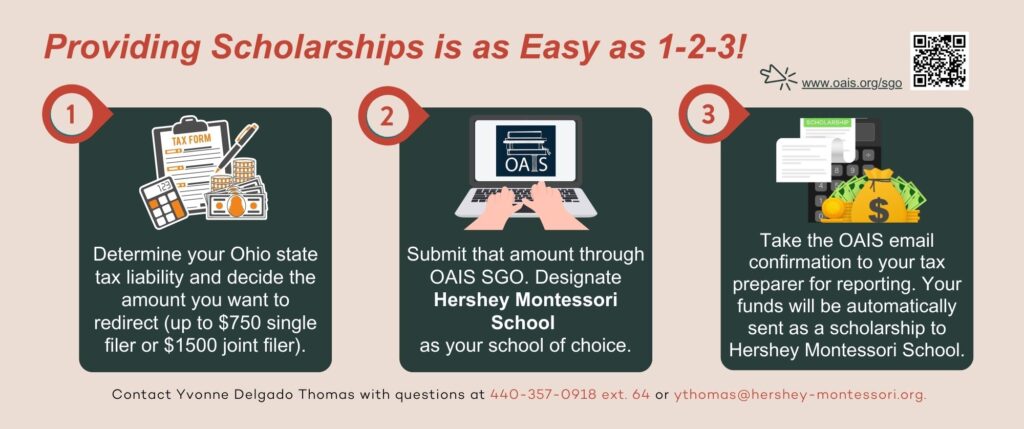

Redirect Your Tax Dollars through Scholarship Donations

The Ohio Tax Credit Scholarship Program lets you give money to private schools, like Hershey Montessori School, that are part of a Scholarship Granting Organization (SGO) with $0 out of your pocket. Each person can donate $750 to a Hershey scholarship fund and get an offsetting $750 in an Ohio income tax credit. A married couple can each donate and get $1,500 in combined Ohio tax credit. This is essentially a “free” donation (paid back by the tax credit) of $750 or $1,500 to a Hershey scholarship fund that helps provide a Montessori education to more students.

This is a wonderful opportunity and impactful way to support student education using your state tax liability. We hope you will take advantage of this program and help support the children that will benefit from a private Hershey Montessori education.

HOW TO DONATE

- Determine your state tax liability.

- Donate up to $750 (single filer or up to $1500 joint filer) by using this link.

- Select Hershey Montessori School as the school to donate your tax dollars to and keep your receipt/proof of donation.

- Tell your tax preparer that you made these donations.

- Share this information with your family and friends so they may do the same!

FREQUENTLY ASKED QUESTIONS

Q: Is the money I redirect from the Ohio taxes that I owe considered a donation?

A: No. Redirecting your tax dollars through an SGO is NOT a charitable donation, but it does give you control over how your tax dollars are used.

Q.: Is there a time frame I must redirect my tax dollars within?

A.: You may use OAIS/SGO to redirect your tax liability whenever you file your taxes, whether it’s in April or a later month.

Q.: Can I choose which student my contribution can go to?

A.: Your scholarship contribution goes to a general pool for your selected school and cannot be directed to an individual student.

Q.: Will Hershey provide me with the OAIS/SGO receipt?

A.: HMS will not have a copy of your receipt as it comes directly to you via email. Your OAIS/SGO receipt is needed for your tax advisor.

Q.: Who do I contact with my questions?

A.: You may contact Yvonne Delgado Thomas at ythomas@hhershey-montessori.org or by phone at 440-357-0918 ext. 64.

We are thankful for the support of local and national programs that support Hershey Montessori.

Box Tops for Education – Collect “box top” labels from General Mills products and send them into the office. You can follow our progress and find other ways to generate free cash for Hershey on the Box Tops at https://www.boxtops4education.com/.

Goodsearch.org – Use goodsearch.org as your search engine to generate funds for Hershey! goodsearch.org, powered by Yahoo!, works like any other internet search engine. For each search you perform goodsearch.org will donate to a cause. Join, choose Hershey Montessori as your cause, and start searching!

Giant Eagle – Do you use a Giant Eagle Advantage Card? If so, a percentage of your sales can be donated to Hershey every time you shop. Register your card. Our school code is 2344. Each time you shop Hershey receives award points to use toward technology devices, classroom supplies and materials.